So you’re interested in starting churning (or maybe you just want to sign up for the best credit cards available to you)? I too was at that same point just a short time ago. I’m still learning a bunch and getting into but I’ve acquired enough knowledge and have a newcomer’s perspective which may be helpful for those starting off.

What is churning?

I would describe churning as moving through credit cards at a pace that is faster than a typical consumer with the specific goal of extracting as much value as possible out of them as possible. If you consider the value provided to you by a credit you have some baseline of underlying benefits (cashback, points earned, etc) but the blended value when taking into account a signup bonus is much higher.

Because of that, if you can manage the complexity and hit signup bonus spending goals, bouncing between cards and closing/downgrading them once you’ve hit the signup bonus will you leave with a higher effective value/dollar spent ratio than if you just use a few cards in a more typical fashion.

Steps

1) Building credit and checking your score

First step to starting to apply to credit cards is to make sure that your credit score is high enough. I would recommend opening an account at Credit Karma and using their free credit scoring to keep track of where you’re at. They’ve also got approval odds by card which I’ve found to be helpful so far so that you can get a sense of how likely it is that you’ll be approved before taking the hit to your credit with the application.

Note: If you’re like me and didn’t have a credit history until recently you’ve basically got three options.

Open a secured card (I happened to do one with Wells Fargo) to build up credit history before getting a real credit card. Secured cards are like credit cards with training wheels. You put up a certain amount of money and then are allowed to spend against it. You’re not actually being given any credit. You can only spend up to what you gave the bank as a deposit. That being said, within 6 months of getting one I was able to apply & get a better credit card (CapitalOne Quicksilver 1.5% Cashback).

Get added as an authorized user on someone else’s credit card. This is probably the best route to take as generally you won’t want to keep using your secured card (they’re all pretty terrible) and may end up closing it eventually (which will hurt your credit score in the short/medium term).

Find a credit card with a very low threshold for approval and hope that your application will be accepted.

2) Types of cards

Second step is getting a sense of what kinds of cards you would like to get. Broadly, there are a few types of credit cards:

- Cashback cards

- Cards with cashback that give you a certain % back for every purchase.

Some of these cards give you more cashback for certain categories of spending either on a permanent or rotating basis

- Cards with cashback that give you a certain % back for every purchase.

- Points cards

- Cards that give you points that you can redeem for different sorts of things depending on the card.

- Points can be very flexible like Chase’s cards (Chase Ultimate Rewards, a favourite of the churning community) where you can transfer them to a variety of partners or much more specific like an airline card where you’re earning points that are only usable for that airline.

- Points are generally more valuable on a value/dollar spent (explained in more detail below) but less flexible than just receiving direct credit or cashback.

- Cards with perks

- Some cards have excellent perks that can make getting them more appealing to you depending on what you happen to value.

- For example

- Entry to airport lounges (Chase Sapphire Reserve)

- Rental car insurance coverage (a standard benefit but better cards have much stronger protections)

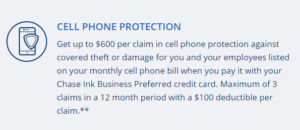

- Cell phone damage protection (Chase Ink Preferred)

- Purchase price protection (if price falls you get money back

- Cards with annual fees

- Generally cards with better sign up bonuses, benefits and cashback/points have annual fees

- You should take into consideration the annual fee when evaluating the benefits offered by the card

- A common tactic is to get a card with an annual fee, make use of as many of the benefits as possible in the first year (sometimes double dipping is possible based on benefit renewals and when annual fees are charged – see more below ) and then downgrade the card to another card from the same company that doesn’t have an annual fee (which will avoid your credit score taking a hit from lowering average credit age, utilization, etc).

- Sometimes annual fees are waived for the first year but will generally be charged after that

3) The 5/24 rule

Before you make your choice you should be aware of some curious limitations that exist in the world of credit cards. Mainly, what’s known as the 5/24 rule which applies to Chase credit cards. Basically, when applying for a personal Chase credit card they won’t approve your application if you’ve gotten 5 credit cards over the past 24 months (i.e. you need to have gotten 4 or less credit cards in the last 24 months). This rule is why there are particular flowcharts (like r/churning’s Credit Card Recommendation Flowchart) that provide you with what’s deemed to be the optimal order to apply for credit cards in.

4) Evaluating the value of a card and its benefits to you (cpp & value/$ spent)

Now that you have an idea of what kind of card you can qualify for, what sorts of cards you might be interested in and what the recommended routes are depending on your situation you can start to make an informed decision on what sort of card/cards you’d like to go after.

I’m mostly following optimized routes based on maximizing returns from signup bonuses currently but I anticipate that I’ll eventually build out some basic spreadsheet models to make decisions between cards based on the types of rewards they are offering (airline miles, cashback, multipliers for certain categories, etc).

I’m proposing a model where you consider value/$ spent. So, consider a scenario where you’re spending $3000 on a card, with that card returning an equivalent of $500 worth of benefits to you, and that card costing you $95 in annual fees (or some other form of direct costs to you). That card would then have an value/$ spent ratio of 405/3000 or 0.135 (with the 405 coming from 500 – 95). Using this model you can evaluate cards more objectively. Ideally you would mock up a spreadsheet with anticipated expenses (and accompanying categories) to get a sense of the return that you would get on your spending from each particular card.

I would generally value Chase’s UR points at 1.5 cpp (cents per point) and Amex’s MR points at 1.25cpp.

5) Applying for business cards

Business cards are interesting because they can have great sign up bonuses and some have great perks (for example the cell phone protection offered by Chase Ink Preferred see below). With regards to Chase, business cards also have the advantage of not counting towards the 5/24 rule so its often recommended you get those first in order to get as many Chase cards (and Ultimate Rewards points) as possible.

Business cards be a bit tricky to obtain as they are meant to be used by businesses and, hence, come with a requirement that you have a business if you want to get one. Don’t fret too much though, something as simple as this blog that I write can count as a business. If you’re earning income and have expenses tied to your business you’ll probably qualify so give it a shot, :)!

Once you’ve applied you may find yourself awaiting review. In that case you can follow this flowchart to figure out what your chances of being approved are and whether you should take any next steps.

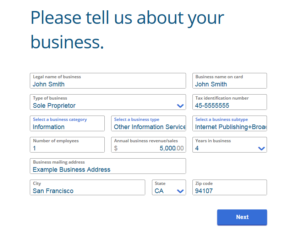

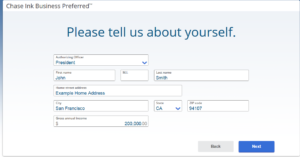

Note: If you’re applying under a sole proprietorship and using your own SSN (if you have an EIN then you should use your business name instead) make sure that you use your own name when filling out the form. Here’s an example of Chase’s business card application flow.

6) Acronyms

Once you get into the world of churning you’ll come across a wide variety of confusing acronyms used without much understandable context for a newbie (like you or me). Here’s my collection of acronyms that I’ve come across so far and managed to grasp an understanding of the following acronyms:

CPP: Cents per point (cents of value per point earned, a typical comparison metric used when looking at the value of points earned through credit cards)

- MO: Money Order

- MS: Manufactured spending

- VGC: Visa Gift Card or Vanilla Gift Card

- MSR: Minimum Spend Requirement

7) Manufactured spending (gift cards, bank sign ups, Plastiq, etc)

I’m just started reading about manufactured spending so I don’t have much to write here yet but the gist of it is that the best way to do a large amount of manufactured spending is to get a certain kind of gift card and then buy a money order with it under a debit transaction. It seems like this has become hit or miss as the most convenient route (buying MOs from the United States Postal Service) doesn’t work the majority of the time. More to come on this later as I continue to read about it.

Update: If you’re not looking to Manufacture Spending for a massive amount of spending then it seems like the best route is to open accounts with banks that accept credit card funding. That way you can open an account, fund it with your chosen card (but make sure you have things set up so you don’t hit with a cash advance fee on your end, more on that here), add extra money beyond the maximum for credit card funding if you’d like to meet conditions for account open bonuses, then withdraw your funds & close the account when it suits you.

You can find a great list of banks that allow for credit card funding here.

For more on Manufactured Spending check out this great breakdown from Frequent Miler.

8) Referral Links

You can find all my referral links here. Consider using them if you found this post helpful, :).

9) Other Links

Chase Business Reconsideration Advice: https://www.reddit.com/r/churning/comments/6hclj4/i_survived_the_dreaded_chase_business/

Chase Business Reconsideration Flowchart: https://i.imgur.com/AZuA0tj.jpg

Credit Card Recommendation Flowchart: https://www.reddit.com/r/churning/comments/9hf4ex/faq_credit_card_recommendation_flowchart/

Banks that allow credit card funding: https://www.doctorofcredit.com/does-funding-a-bank-account-with-a-credit-card-count-as-a-purchase-or-cash-advance/

Avoiding cash advance fees: https://www.doctorofcredit.com/how-to-avoid-cash-advance-fees/

Manufactured spending breakdown: https://frequentmiler.boardingarea.com/manufactured-spending-complete-guide/

Chase business card application flowchart (reconsideration/approval): https://imgur.com/a/oXlPW